Do single-income homebuyers exist? You bet they do! With many millennials postponing marriage and some single parents looking to buy homes, the number of single-income homebuyers is increasing.

Buying a smaller home may be the perfect choice.

Determine your credit score

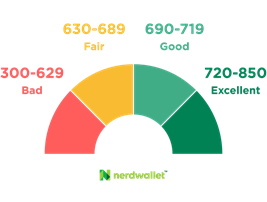

First of all, know your credit score and make it impeccable. The better your credit score, the easier it is to get a loan. Check to see that any late payments and collections have been settled before applying for a loan. Since there is only one credit score to consider, it needs to be excellent.

Aim for a high credit score ranking.

For tips on raising your credit score, see https://www.investopedia.com/how-to-improve-your-credit-score-4590097

Look at the big financial picture

Analyze your financial big picture, considering savings and cash flow. You need enough funds to cover closing costs and a downpayment. According to Canadian real estate pro and former TV host of HGTV’s Buy Herself Sandra Rinomato, you should think of what property fits your needs 99% of the time. Rinomato says that “sacrifices should come in space on the interior because people always overestimate what they really need.” A small home might be perfect and will be less expensive.

Minimize debt

Minimize your debt. Avoid making large purchases with credit cards in the months leading up to your loan application. Pay off student loans and car loans as much as possible to increase your FICO score.

The 28/36 rule is used by many.

More info can be found at https://www.thebalance.com/how-to-buy-a-home-on-one-income-5217336.

Consider loan options

When applying for a loan, consider government loan programs. Daniel DeGuglielmo of Caliber Home Loans advises, “FHA, VA and USDA loans can be great options for first-time homebuyers, with low or no down payment requirements.” You also might consider having a co-signer or guarantor on the loan. Having a co-borrower can make loan approval easier and can result in better terms. Keep in mind, however, that the co-signer bears responsibility if you should not be able to make payments. Read more at

https://www.danieldiguglielmohomeloans.com/single-newsletter/tips-for-buying-a-home-on-one-income.

Consider income protection

Some lenders may require some type of income protection plan. If your employer does not provide disability insurance, consider buying a policy on your own. This would provide help in paying your bills in case of an accident or illness. Another option is to purchase a mortgage protection life insurance policy. This is a specific product designed to help with home loan payments should you become unable to work.

So, if you’re considering becoming a single-income homebuyer, don’t think of homeownership as impossible. Analyze your financial situation, know what to expect in the loan application process, and secure a reputable Realtor® to help you find just the right home.

Let any of our expert realtors at ahousethatfitts put you on the path to homeownership.

—- Bottom Line —-

Looking for a perfect house for a single-income homebuyer?

Call us at 205.248.7353 or send us a message. We’ll help you take your first step toward finding “A House That Fitts.”

Don’t forget to SUBSCRIBE to the Carrie Fitts Real Estate YouTube channel today for more exciting news from our dynamic, community-oriented Realtors®!